Facing unprecedented challenges to their core businesses, television broadcasters in Europe and other markets that rely on DVB-based technology are hoping to turn internet-driven change to their advantage. It’s clear that the fragmentation of audiences and monetization spawned by the emergence of OTT services has set a new course for a large number of broadcasters across the DVB footprint globally.

Intensifying competition from OTT providers

With a new wave of OTT services like Disney+, HBO Max, Paramount+, Apple TV+, and Peacock entering the market from the U.S. and many others sprouting up across the globe, there’s broad consensus among researchers and investment analysts that OTT revenue totals and viewing metrics will continue to surge for the foreseeable future. Digital TV Research, in a projection typical of many, says global OTT revenues will reach $159 billion by 2024, more than doubling revenues from 2019.

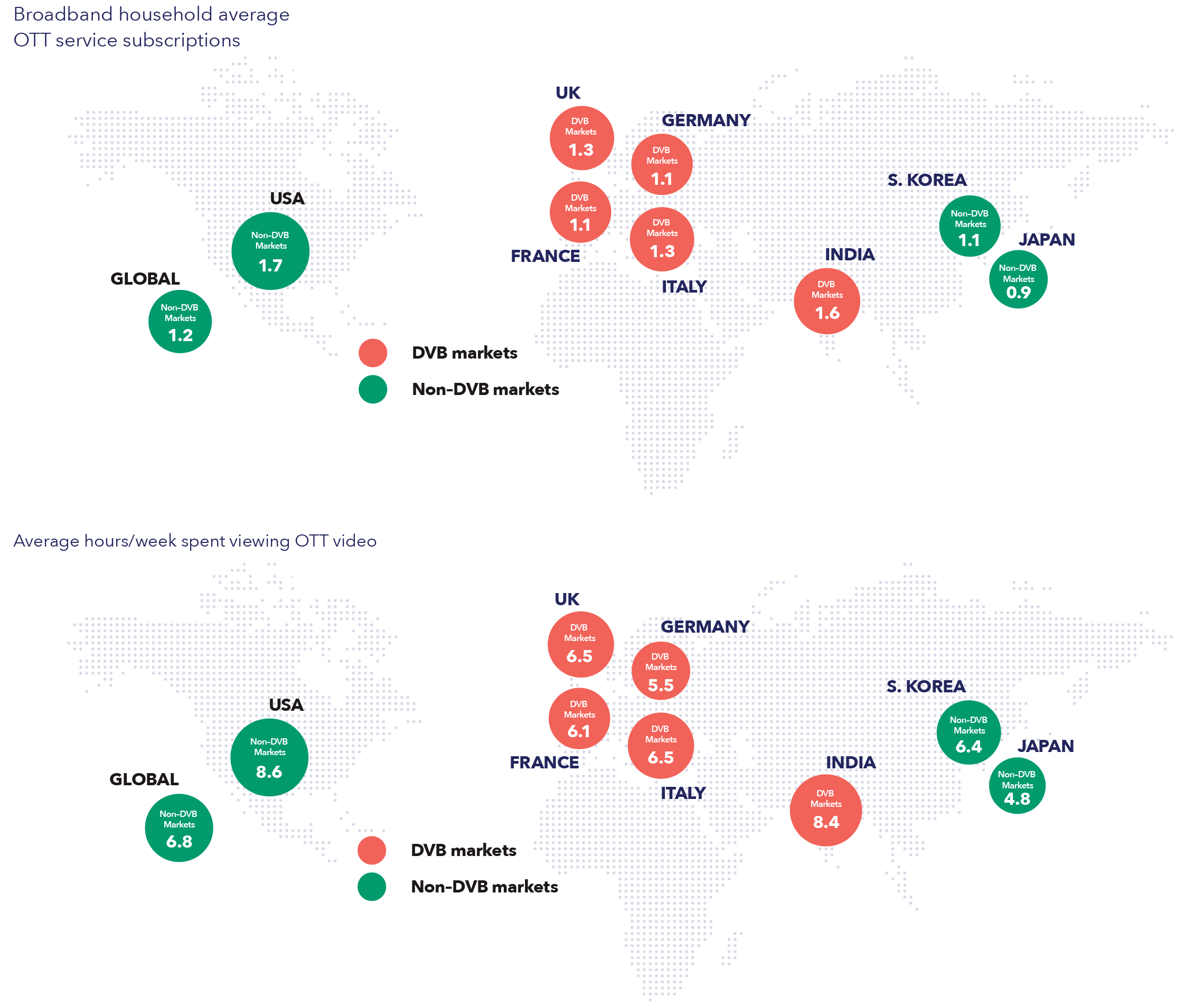

Going into 2020, the researcher said there were 461 million subscribers signed up for 714 million OTT service subscriptions worldwide, an increase of 86.6 million subscriptions and 37.1 million subscribers over the previous year. By 2024, it projects there will be 531.5 million subscribers accounting for 947.5 million subscriptions, representing an average of 1.78 subscriptions per subscribing household.

OTT in DVB markets

In DVB markets, OTT service subscriber counts measured in Q1 2019 were up over Q3 2018 nearly everywhere, including Europe. Even though European regulators have imposed a 30% European content requirement on OTT services, providers like Netflix and Amazon are doubling down on acquiring additional European content producers to develop more in-house content.

One recent research report predicts that the OTT video subscription count will reach 197 million in Western Europe by 2025, doubling the year-end 2019 total. Other metrics showing how the OTT trend in some DVB markets compares to trends in non-DVB markets and the overall global trend are summarized in the figure below.

DVB broadcasters’ growing role in OTT services

With all that’s at stake for DVB broadcasters, the industry is pursuing the shift to direct-to-TV services with increasing urgency but also with growing confidence in the upside. To the extent broadcasters can capitalize on advertising trends in the OTT market, they have the opportunity to more than compensate for the falloff in legacy TV advertising by leveraging what can be accomplished operating online, unfettered by the limitations of one-way broadcast distribution.

So far, broadcasters’ OTT strategies have revolved around two approaches. On one track, individual broadcasters are offering online VOD, also known as Broadcaster VOD (BVOD) services, many of which are going beyond providing time-shift options for their DTT content to include ever more original programming. Ad-supported BVOD platforms like ITV Hub, All4 and My5 in the U.K., SVT Play and TV4 Play in Sweden, France Télévisions’ France.tv, Mediaset Play in Italy, Freeview in Australia, and a myriad of others are ideal launch pads for more aggressive direct-to-TV strategies.

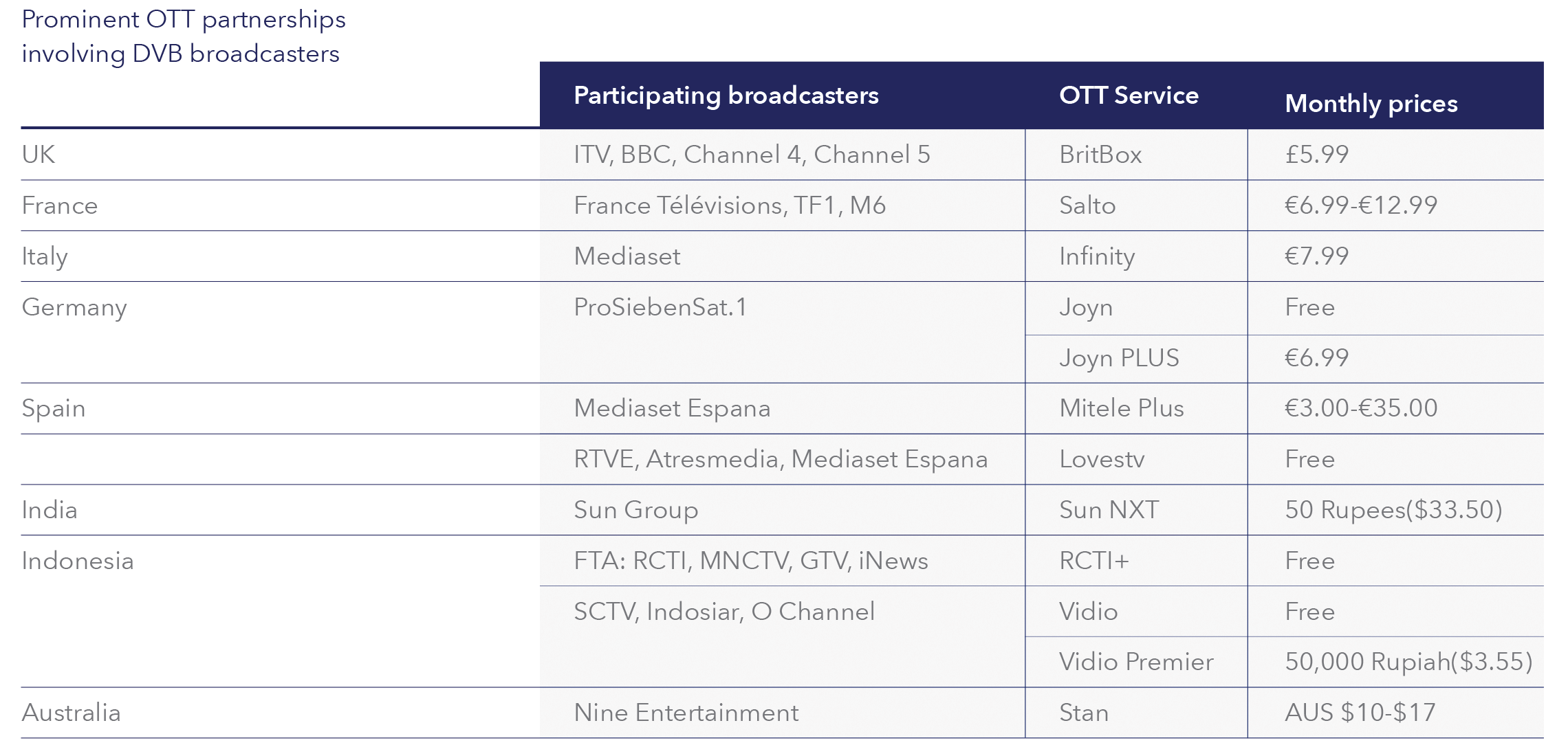

On the other path to direct-to-TV, there’s been more full-blown OTT service launches in DVB markets driven by broadcasters, often in partnership with international programmers or other entities. Examples of some of the more prominent partnerships are listed in the figure below.

Hybrid is the future of TV

The emergence of the smart TV as a mainstream viewing platform in DVB markets has provided broadcasters the ideal environment for delivering combinations of legacy and internet-delivered programming and features that consumers can’t get anywhere else.

While the hybrid approach will surely help businesses better meet customer needs and even provide new advertising opportunities, it also presents new security problems. Intertrust’s ExpressPlay Media Security Suite is a cloud-based content protection service to help rights owners and distributors keep their assets secure and profitable. Learn more about the solution today.