The subscription video on-demand (SVOD) streaming landscape is becoming increasingly crowded with big brand names. It started with the pioneering innovators like Netflix, Amazon Prime, and Hulu. But recently a new crop of media giants is joining the fray. Disney+ and Apple TV+ launched late in 2019, and two more entrants arrived shortly after—Comcast’s Peacock (April 2020) and AT&T’s HBO Max (May 2020).

Time will tell how much the newcomers will disrupt the top-two streaming picks, Netflix and Hulu. In Netflix’s reported fiscal 2019 fourth quarter results, US OTT video subscription growth fell about 180,000 short of their forecast. Yet, Netflix gained an impressive 1.3 million more international OTT video subscriptions. For another positive indicator, research from the NPD Group found that in 2019 Netflix and Hulu’s weekly viewing hours rose 7%, growing to 4 hours 6 minutes, which amounts to 20 minutes more streamed TV content per week than in 2018.

Big media companies joining the streaming marketplace

Driving Disney+’s impressive launch are the subscribers drawn to its family-friendly and nostalgic media library. While smaller than Netflix’s, it contains films like Star Wars, Disney favorites like Finding Nemo, and The Simpsons to name a few. It’s estimated that Disney+ brought in 24-million US OTT video subscriptions in November of last year.

Apple is in a unique position among its new competitors by virtue of its multi-faceted, if not confusing, various offerings. There’s the Apple app for iPhones and Macs, which is a hub for video entertainment and includes its own iTunes rentals. There’s the very recognizable Apple TV set-top box. And then there’s the newly launched Apple TV+, which is a paid service with Apple-exclusive video entertainment on multiple platforms, including Roku. While so far Apple TV+ includes a handful of original shows that haven’t been met with overwhelming recognition from the likes of the Golden Globes or the Screen Actors Guild, they can boast of signing up 33 million customers.

With AT&T’s HBO Max offering, existing HBO subscribers on AT&T (approximately 10 million) and HBO Now direct billing subscribers will get HBO Max for free. And customers who subscribe to AT&T’s premium video, mobile, and broadband packages will be offered bundles at launch with HBO Max at no additional cost as reported by Variety.

Confident of their ability to harness the current wave of streaming growth, HBO Max is projecting that by 2025 they’ll have 50 million US OTT video subscriptions, and between 75 to 90 million global customers.

Comcast’s Peacock is also entering the US market this spring. According to a December 20 CNBC report, “Users will be greeted by streaming content, similar to turning on traditional television, according to people familiar with the matter. The showcased video could be a live offering from NBC News Now, NBC’s free streaming news service that will integrate with Peacock, or an on-demand show.”

Cord cutters face mounting monthly bills as marketplace grows

While many viewers are finding it hard to wrap their minds around the huge array of entertainment possibilities, this tyranny of choice comes with a mounting price tag. Many cord cutters are realizing they must decide on their favorites after looking at their monthly bills, which can start to add up.

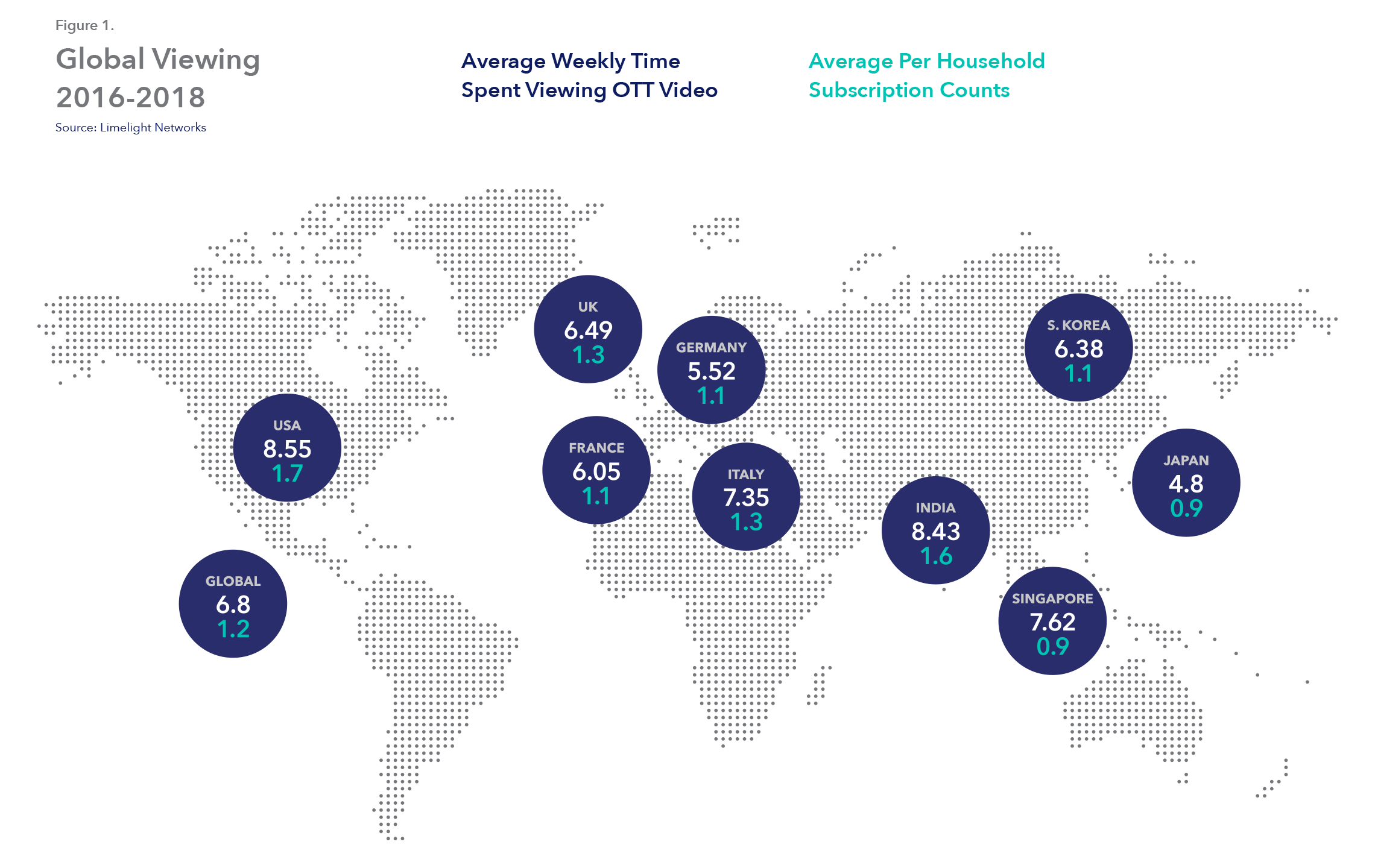

According to the researcher Statista, the worldwide price average for just one OTT video subscription is $23.22. Globally, the average number of over-the-top (OTT) subscriptions per viewer is 1.2, with the US in the lead again at 1.7 (see Figure 1).

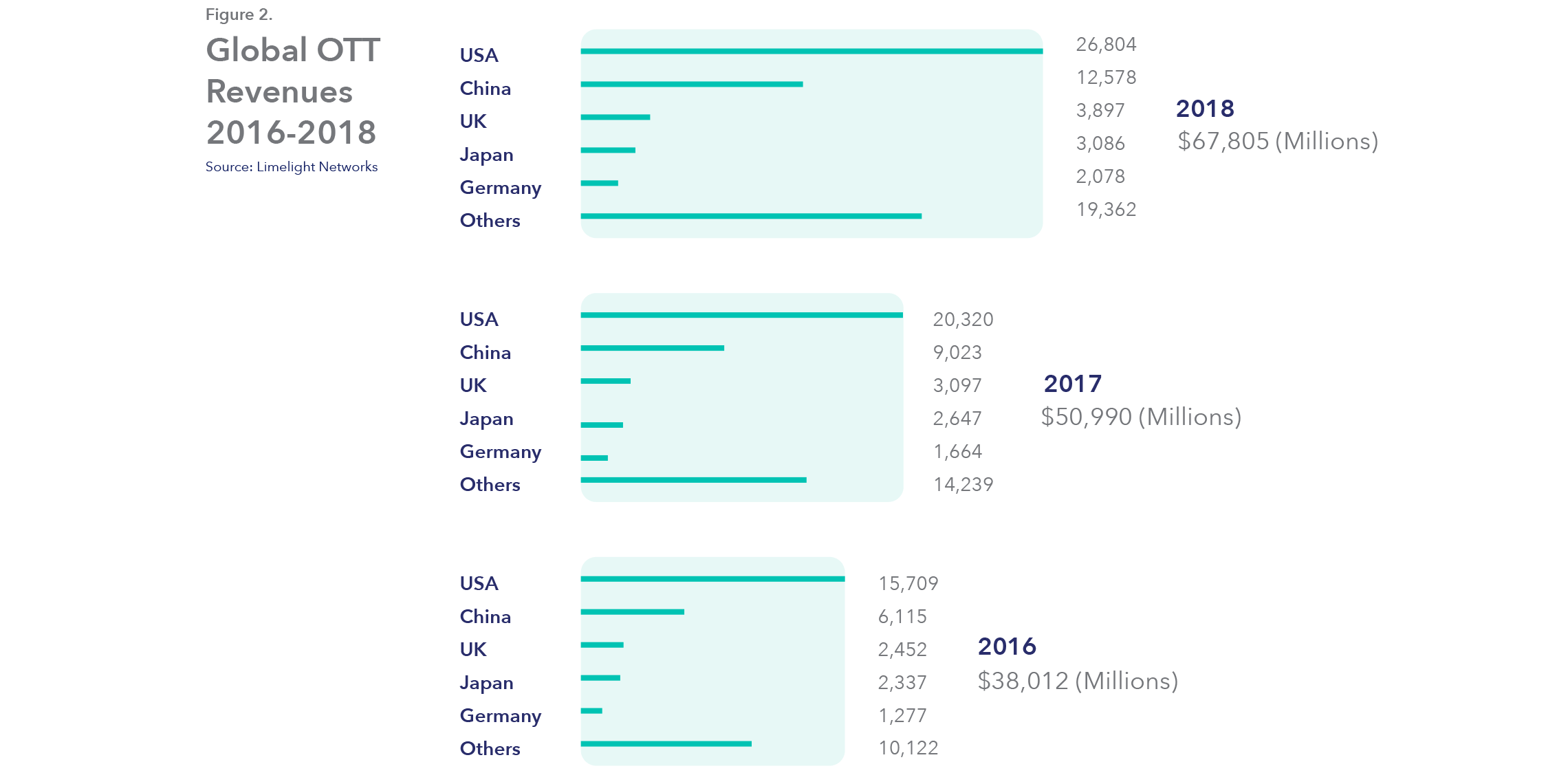

Taking a look at the figures surrounding streaming growth and current OTT momentum, revenue generated by global streaming services in 2018 totaled $68 billion, up $30 billion or 79% from 2016 with 53% generated by OTT video subscription fees and the remainder accruing from advertising according to Digital TV Research. The US accounted for $26.8 billion or 39% of the total, which is by far the largest share of any country (see Figure 2).

Digital TV Research projects streaming growth will greatly increase global OTT revenues, suggesting that they may reach $159 billion by 2024, doubling from 2019.

And the surging percentage of viewing time going to OTT video content in tandem with rising revenue numbers are a clear sign of how streaming growth is changing the entertainment landscape. Globally, viewers are spending an average of 6.8 hours per week consuming OTT video, with the US topping the national averages at 8.55 hours according to a report from CDN operator Limelight Networks.

Increasingly, OTT distributors are targeting audiences beyond their countries of origin. According to Media Asset Capital, one fourth of European OTT services are pursuing cross-border audiences. Worldwide, the cross-border reach enabled with OTT distribution has become a driving factor behind streaming growth and specifically the explosion in regional online video services, according to a report on global trends from Parks Associates.

Tier 1 network operators like AT&T, Comcast, Dish, Sky, Vodafone, Orange, Deutsche Telekom, SK Telecom, Telkom Indonesia, NTT Docomo, and many more have made big investments in OTT services, often with their cross-border audiences in mind. And with video usage on mobile growing at a rate of 50% to 60% annually over the past five years, forecasts from the Mobile Video Industry Council suggest video will eventually account for 90% of 5G traffic according to Openwave Mobility.

Content piracy threatening ROI and changing business models

One of the consequences of this rapid streaming growth and the radically transformed OTT marketplace is the increase in piracy and the illegal re-distribution of valuable video content. Digital downloads, and now streaming, have made it easier for content pirates to obtain and distribute illegal copies.

Digital TV Research predicts that piracy of online TV and movie content across 138 countries will nearly double from 2016 to 2022, reaching as high as $51.6 billion in lost revenue for content owners—crushing the dreams of success for many emerging streaming services. Video Piracy: Ecosystem, Risks, and Impact estimates that if just 10% of pay-TV subscribers discontinued pay-TV services in favor of video delivered by pirates, the 2023 loss to those operators could approach $6 billion.

Movie studios are shrinking their release windows over the last several years, getting their latest blockbuster online before pirates can gain traction with their illegal copies and decrease studio ROI. Now, secondary release windows are down to weeks or less, with studios focusing on protecting their investment inside and outside the theater.

If piracy continues to be an option for many around the world, the revenue and subscriber growth of OTT will plateau, stifling innovation and creativity, and reducing the motivation and financial justification for digital rights holders to continue producing top-notch, compelling content.