As part of our thought leadership series, we’re featuring interviews on key energy-related topics with Florian Kolb, Intertrust’s Chief Commercial Officer and General Manager, Energy.

—How is the energy sector evolving? Are there any global trends driving innovation?

The energy sector has changed considerably over the last five years. As demand for energy and overall energy consumption becomes more volatile, legacy approaches have given way to a new model built on three key innovation mega-trends. The first of these trends is the move to renewable energy, with the corresponding decentralization of existing energy systems. The second trend is the increase of e-mobility. The third is deregulation, which has led to a liberalization of energy markets and decreased protection for utilities.

A foundational driver for these trends is the global focus on climate science, which culminated with the 2015 Paris Agreement. To meet the CO2 emission reduction goals for 2030, a substantial global investment in renewables, e-mobility, and energy conservation will be required. Companies at all levels are getting involved in making this investment. There are classic utilities, the so-called “poles and wires” companies, as well integrated utilities. But even major oil companies such as Shell are paying attention to the alternative energy value chain.

—How quickly can these changes happen?

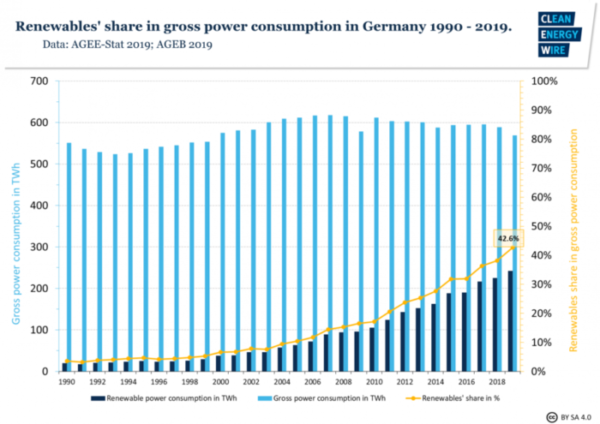

These trends and the forces behind them are long-term processes and structural changes. A full shift to renewables is not going to happen overnight. If you look at Germany, for example, in 2019 the overall generation capacity was around 42% renewables (wind and solar). The baseline in 2000 was around 7%. So, to move from 7% to 40% took nearly 20 years.

Image source: Statista

Another key trend in Germany is “sector coupling,” the interconnection between energy consuming sectors, such as transport, industry, and buildings (heating and cooling) and power-producing facilities. Right now, for example, transport and buildings rely significantly on fossil fuels. Sector coupling envisions an integrated system powered exclusively by renewables, where “clean” electricity is the primary energy source. But it also raises other questions regarding energy storage and distribution.

—Renewables are seen as more expensive—are they?

One of the key things that has changed over the last years is the business case for renewables. In the past, renewable energy was seen as a luxury—you needed to be pretty wealthy to afford it. Governments offered renewable subsidies and tax credits, which has resulted in a significant drop in costs for renewable projects. Wind and utility-scale solar costs have fallen so much that it’s often cheaper to go the renewable route than conventional generation.

In a tense economic situation such as what we’re facing now during the COVID-19 crisis, renewables are a better choice. Oil price is very low, so the pressure is on for the oil majors to come up with alternatives. Shell, for instance, is investing a great deal into renewable energy, electric mobility, and energy storage.

—Do you think COVID-19 will have an adverse impact on innovation in the industry?

The industrial-scale investment planning and building cycles for wind, solar, and storage are complex projects that naturally take a long time. From an investment perspective, energy is relatively resistant to crisis. Utilities are called utilities for a reason. Whether or not there’s a crisis, people need to wash. Whether or not there’s a crisis, people need electricity.

If you look at the demand swings for electricity in a situation like this, they are also pretty low. There is so much baseload electricity consumption, that the delta might be something like a few percent, which is not a big issue at all for a utility company. Industrial electricity needs will not massively affect the consumer market during this pandemic, because those big industries (e.g. chemicals) tend to produce their own power or source directly from the wholesale market.

So, while investments and buying cycles may slow down, I don’t think that COVID-19 will have a lasting impact on longer-term energy developments. It may even lead to increased innovation. The crisis will push further for digitization, because we’re relying so heavily now on the internet and doing things online. To increase the resilience of the system, you need to be able to do things remotely—you need to connect either to customers or to operations and assets.

I think we will see a strong increase in the demand for data-driven insights after the crisis is over. Data produced throughout the energy value chain is already growing exponentially. How can companies run their assets more efficiently? How can more volatile energy sources be integrated? What’s happening on the customer side? The answer is in the data.

Stay tuned for the next installment in the series which will cover data-driven business models and data interoperability.

About Florian Kolb

Florian Kolb joined Intertrust as Chief Commercial Officer and General Manager, Energy in January 2020 after a 15-year career in a series of business leadership roles within the German energy industry. He is responsible for all of Intertrust’s product sales and business development activities, as well as the company’s initiatives in the energy and related industries. Read more